So you need a roofer

Most people will get a referral, check online reviews, maybe the website and do their “research.” The only problem with relying solely on your research is often times it’s hard to determine whether or not the contractor you’re hiring has Commercial General Liability Insurance and Workers Comp.

Just because they have great online reviews and a nice website, don’t assume they are carrying the proper insurance. It’s expensive to carry and some contractors will take shortcuts to increase their profits.

Make sure you ask your contractor for proof of insurance!

Pursuant to California Business & Professions Code β7159.3 [sb 2029], Home Improvement Contractors must provide this notice and disclose whether or not they carry Commercial General Liability Insurance.

Home Improvement Contractors must provide this notice and disclose whether or not they carry Commercial General Liability Insurance. This statement must accompany the bid, if there is one, and/or contract.

What exclusions does the policy have?

Many contractors have cheap insurance with very important exclusions. The course of roofing/open roof exclusion is one example. This would exclude virtually any damage during the project from coverage.

What does this Insurance cover? Commercial General Liability Insurance can protect against third-party bodily injury and accidental property damage. It is not intended to cover the work the contractor performs.

How can you make sure the contractor is insured? If he or she is insured, your contractor is required to provide you with the name and contact info of the insurance company. Check with the insurance company to see if your project will be covered.

Choosing an uninsured roofer puts your property, assets and financial security at risk if someone is hurt on the roofing job. Don’t risk it – an extremely low bid is always a big red flag. Also, if your roofing contractor is using a “torch down” application, there are special insurance requirements to do so. Make sure they have it in case this happens.

We always carry the proper insurance

San Diego County Roofing, Inc. shall purchase from and maintain with a company or companies lawfully authorized to do business in the jurisdiction in which the project is located:

1) A Comprehensive General Liability Insurance Policy in the amount not less than $1,000,000.00 per occurrence and $2,000,00.00 aggregate.

2) A contractor’s Surety Bond in an amount not less than $12,500.00, mandated by the California State Contractors License Board.

3) A Worker’s Compensation Insurance Policy in the amount not less than $1,000,000.00 per occurrence, which is mandated by statute.

Any questions about insurance? Reach out to us anytime 855-732-6868 or email info@sandiegocountyroofing.com or Request an Estimate online.

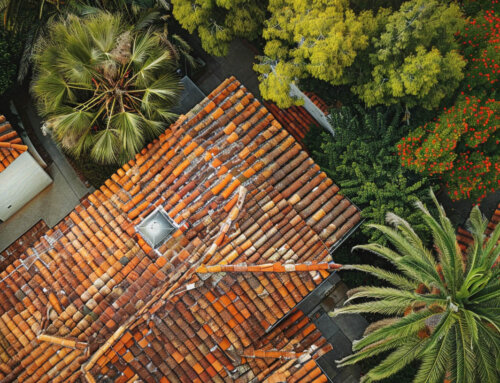

Learn more about Drone Inspections